Lab 040: Money Moves

About This Lab

This week we talked to Natalia Brzezinski about Klarna and other financial technology applications.

Now if this feels familiar, you may be recalling an introductory lab to financial technology (fintech) in Lab 021 - New Bank Account, Who Dis? However this lab is taking a deeper dive on a specific type of fintech - buy now, pay later (BNPL) platforms. Popular BNPLs include Klarna, Afterpay, and Affirm.

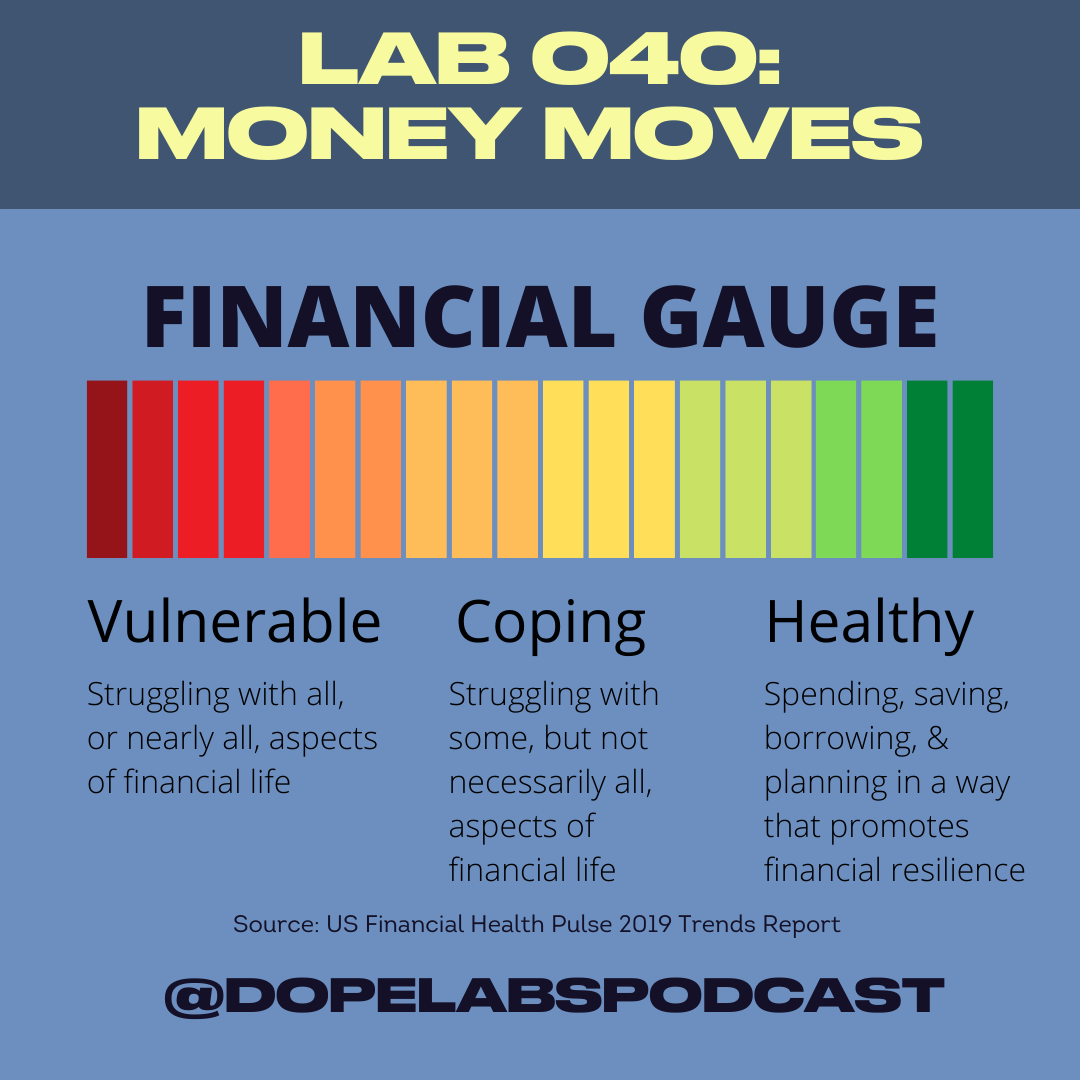

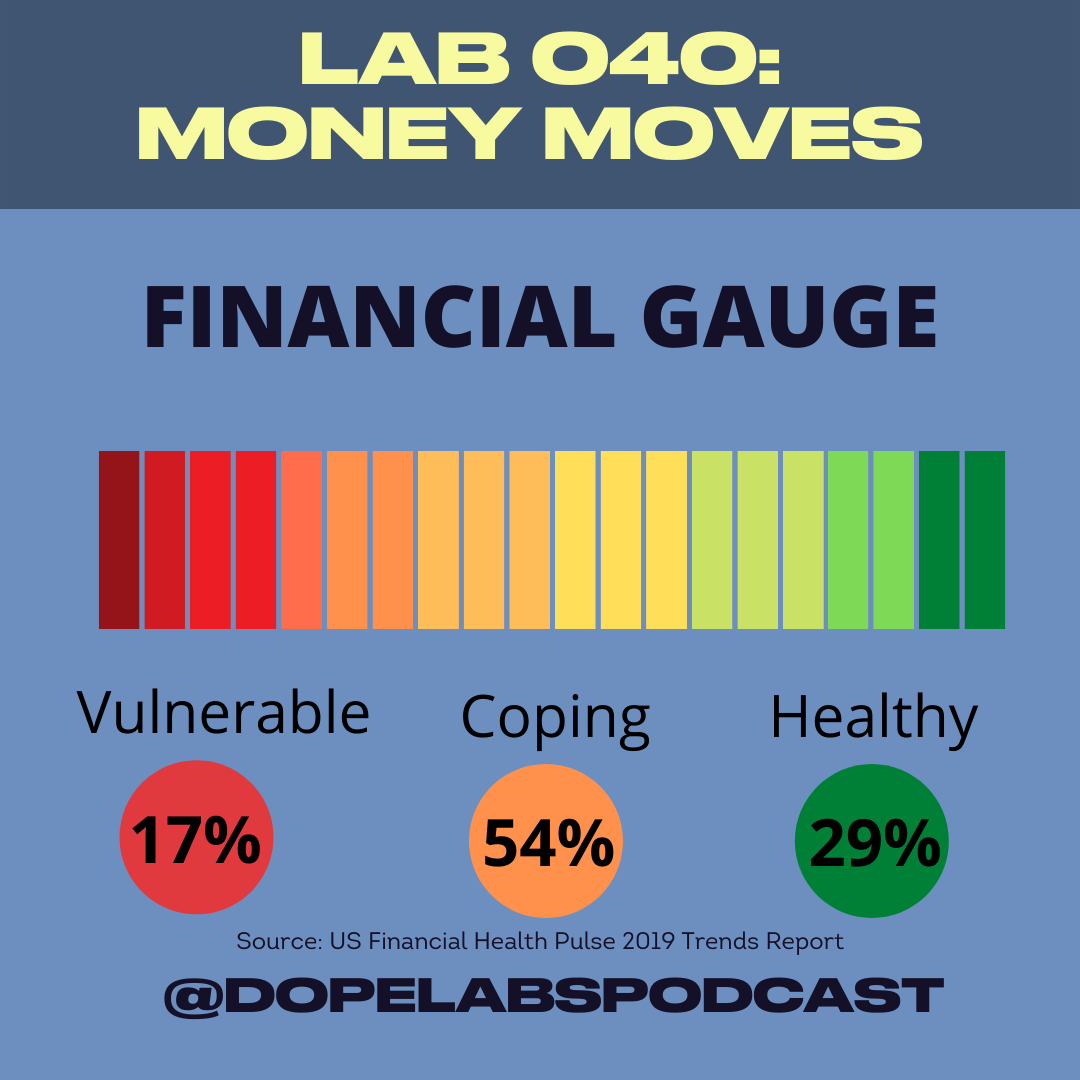

American Financial Health

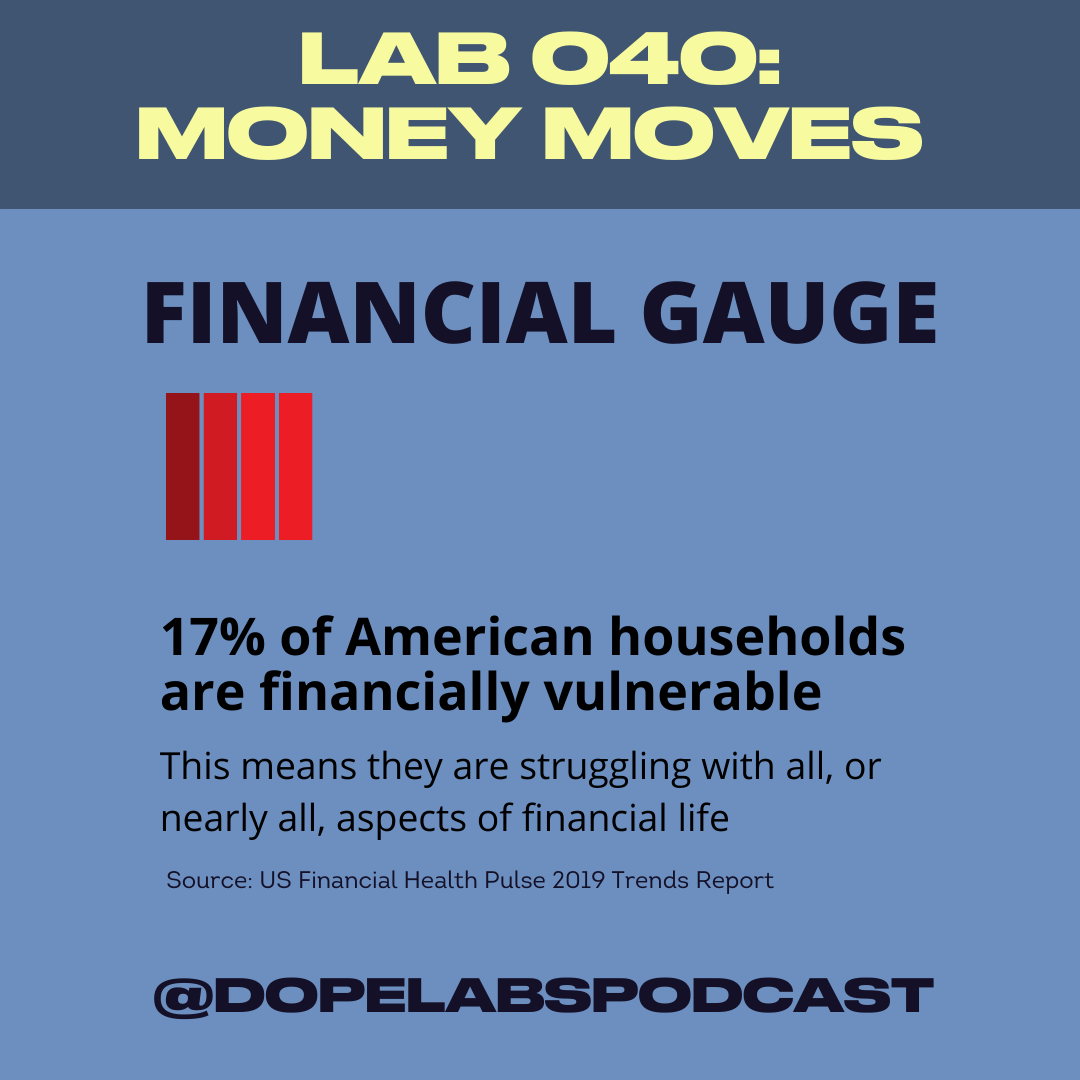

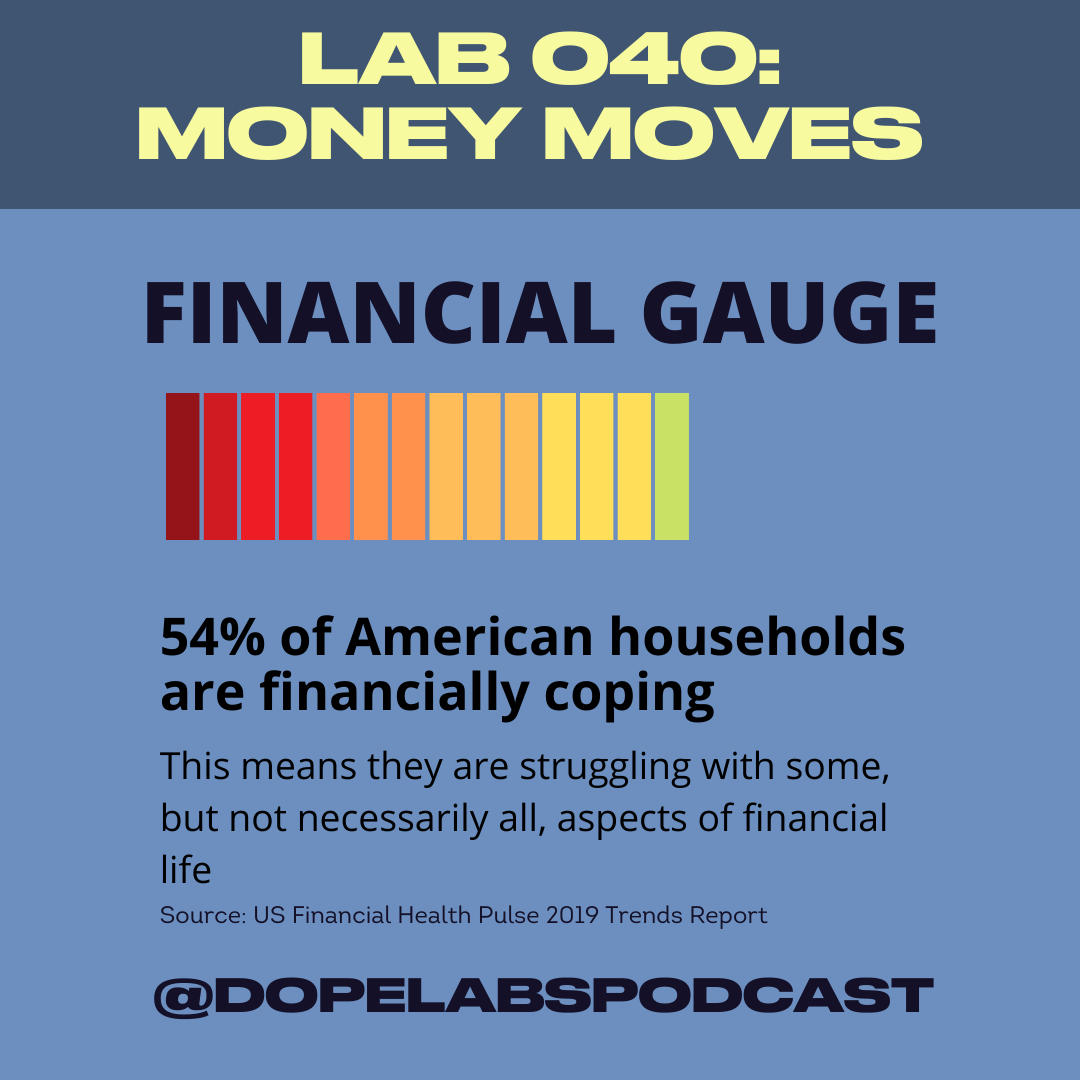

Only 29% of all Americans are considered financially healthy. If you look at Americans making less than $30,000 a year? That financially healthy slice drops down to 10%. (US Financial Health Pulse 2019 Trends Report).

Over 25% of American households are unbanked or underbanked according to the 2017 FDIC Survey of Unbanked and Underbanked Households.

In unbanked households, no one in the household has a checking or savings account

In underbanked households, someone has an account at an insured institution, but they also obtain financial products/services outside the banking system. Alternative financial services include but aren’t limited to payday loans, rent-to-own services, pawn shop loans, check cashing services, etc.

In unbanked households “not having enough money to keep in an account” and “don’t trust banks” were the two most common reasons reported for not having an account.

Beyond cash on hand, there’s also the issue of access to credit. The rate of credit application denials and access to credit below the requested amount differ by race and ethnicity and income level.

Overall, there’s a real need for additional indicators and systems to measure financial health.

Percentage Credit Applicants Denied or Offered Less Credit by Race/Ethnicity & Income

How can fintech become a player in the financial market? Are buy now pay later plans useful tools to improve your financial health? What are the potential benefits and what are the risks? Listen to our lab to learn more!

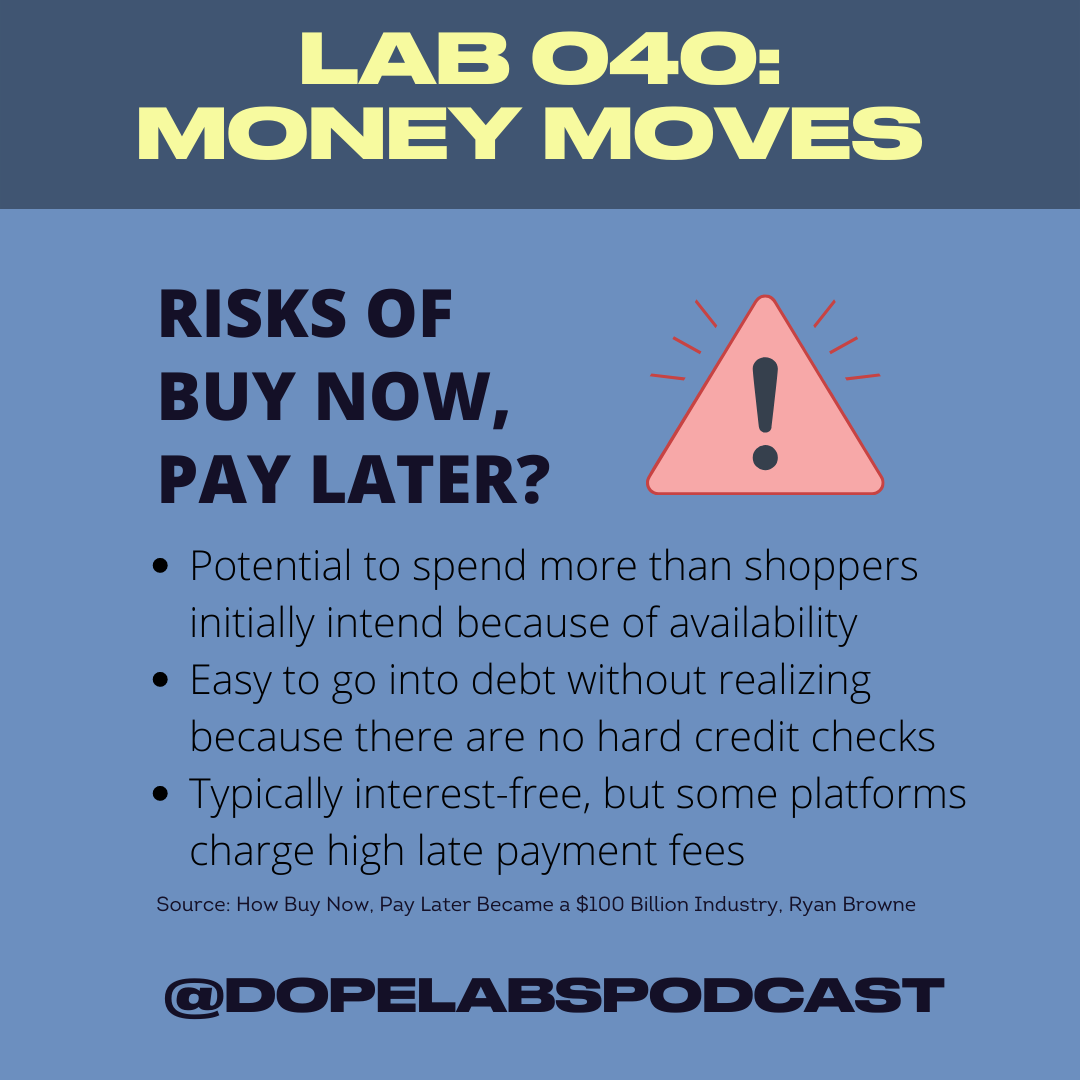

Like any product, there are costs associated with BNPLs. And even though most of the cost for BNPLs are covered through merchant fees instead of charging customers for access to the platform, there are fees associated with falling behind on your plan. Remember, any money you spend that isn’t in your account right now is technically credit. Consider your unique financial situation and whether BNPLs are the right tool for you. Even if you decide a BNPL is good for you, each BNPL has it’s own system of late fees and structured payments, so you’ll have to do an additional look around the BNPL landscape to find the best match for your situation.

Additional Reading

The Costs of Being Unbanked or Underbanked by Emily Guy Birken

Leveraging Fintech for Financial Health by Mary Bogle, Kassie Scott, Jorge González-Hermoso, and Brett Theodos

‘Buy Now Pay Later’ Installment Plans Are Having a Moment Again by Max Reyes

Guest Expert

Natalia Brzezinski is the US Head of Strategy at Klarna. Natalia, is an experienced moderator, journalist, and communications strategist focused on building dynamic dialogue across numerous sectors and cultures. She has held cutting-edge roles in the U.S. Senate Press Office for Senator John Kerry, to The Huffington Post, to the U.S. Embassy in Sweden focusing on the intersect of digitalization and diplomacy, innovation and leadership.

Transcript

You can read the transcript here.